Investments

•04 min read

Bonds have gained traction as a reliable investment option in India because they offer a stable source of income and help diversify your portfolio. In this post, we discuss how to maximize returns with bond investment strategies in India while simplifying how each strategy works. You will learn about the structure of bonds, the different types available such as government bonds, corporate bonds, and even municipal bonds, along with step-by-step guides for popular bond strategies like laddering, barbell, and bullet methods.

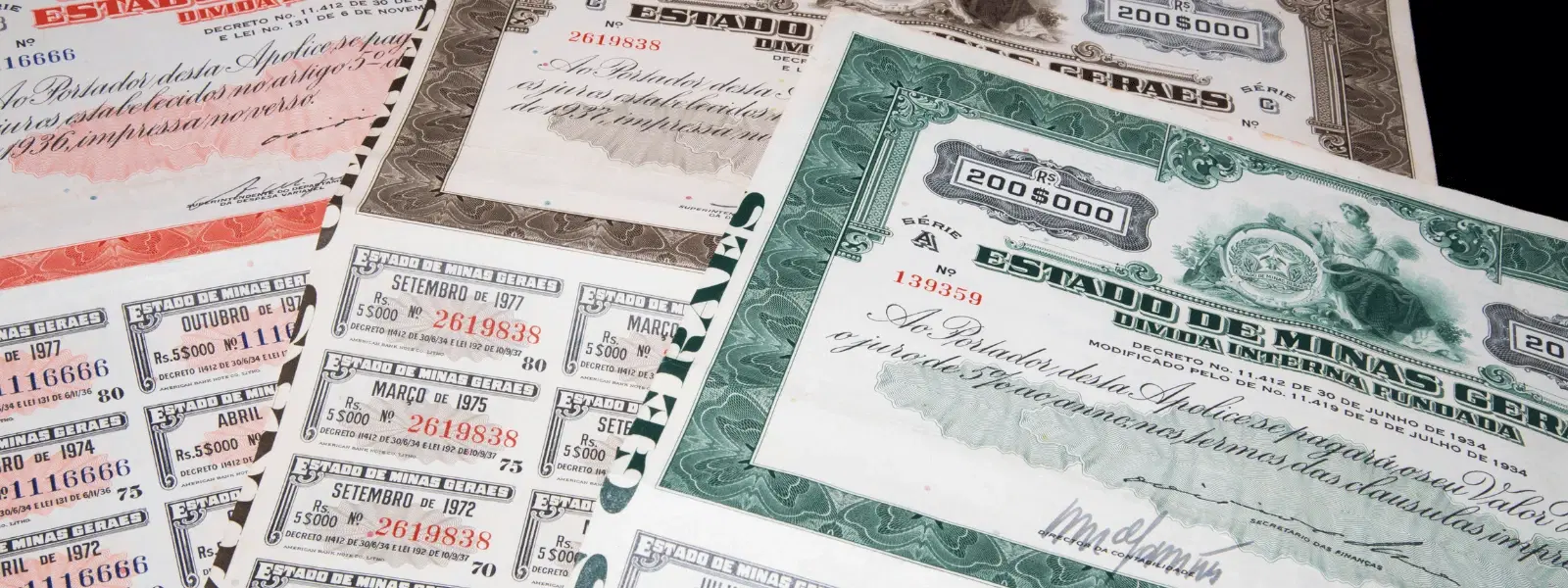

Bonds are fixed income securities that act as loans given by investors to issuers such as governments or corporations. Investors earn returns through periodic interest payments known as coupon payments and receive the principal back upon maturity. Bonds play an important role in a diversified portfolio by balancing risk and providing a steady income stream.

Regular interest payments mean that bonds can offer predictable cash flows, which is an attractive feature for investors who seek steady income. This regular income can help manage your household finances reliably. Moreover, bonds often reduce portfolio volatility by counterbalancing more unpredictable investments. They help in capital preservation as well, particularly in the case of government bonds. In India, bond investment options include government bonds, corporate bonds, and even debt funds or bond mutual funds, providing a variety for investors with different risk profiles.

Government bonds are debt securities issued by the government with a promise to pay periodic interest and the principal amount upon maturity. In India, these include fixed-rate bonds, floating rate bonds, sovereign bonds, and inflation-indexed bonds. The main advantage of government bonds is the sovereign guarantee they offer, ensuring that the principal is safe. However, they often offer lower bond yields compared to other investment options.

Corporate bonds are issued by companies and usually come with higher returns compared to government bonds, though they also carry a higher risk due to the possibility of default. Types such as convertible bonds and callable bonds provide more flexibility for both the issuer and investor. With corporate bonds, investors can enjoy competitive yields while weighing the increased risk inherent in these instruments.

Municipal bonds are issued by local government bodies to fund community projects. They often come with tax benefits, making them attractive to investors looking for tax-free bonds. However, investors should be aware of potential risks such as lower liquidity compared to other bonds.

The laddering strategy involves investing in bonds with different maturities. By staggering maturity dates, you spread out the risk of reinvestment and manage liquidity effectively. This approach allows you to reinvest in new bonds as older ones mature, potentially capturing better bond yields when interest rates are favorable. To implement a laddering strategy, begin by selecting bonds that mature at different times, then reinvest the principal as each bond reaches its maturity date.

The barbell strategy focuses on balancing investments between short-term and long-term bonds. By doing so, you secure part of your portfolio in bonds that mature quickly, providing liquidity, while the long-term bonds offer higher fixed returns over an extended period. To apply this strategy, allocate a portion of your investment in short-term bonds to manage immediate liquidity needs, and invest the remaining amount in long-term bonds to maximize overall returns.

The bullet strategy targets bonds that mature on the same date. This is particularly useful if you have a specific financial goal in mind, such as funding education or preparing for retirement. With this approach, you time the maturity of all your bonds to coincide with the expected need for funds. This strategy offers clarity and simplicity as you can plan your investment around a single future date.

When selecting a platform for bond investment in India, a user-friendly interface is essential, ensuring that the entire process is straightforward. Transparent pricing and clear fee structures help you understand all costs involved. Additionally, platforms that offer extensive educational resources and robust customer support can greatly enhance your investment experience and help you navigate the bond market confidently.

Many digital platforms now offer seamless journeys for bond investment. A fully digital process, which includes completing KYC with PAN card, Aadhaar, bank, and demat account details, makes it simple to start investing. Once you have completed the digital requirements, selecting a bond and making payments via UPI, Net Banking, or IMPS is all done at the click of a button. Bond units are then transferred to your demat account within one to two days, with returns credited to your linked bank account after accounting for applicable TDS on interest.

It is important to invest through platforms that comply with regulatory guidelines. A thorough understanding of the regulatory standards ensures that your investments adhere to the required norms, protecting your interests. This should be a priority when you evaluate any investment option, including government bonds and bond mutual funds.

Investing in bonds is not without risks. Credit risk is a key consideration, as there is always a chance that the issuer may default on payments. Also, interest rate risk can impact bond prices; when interest rates rise, the market value of existing bonds may decline. Inflation risk is another important factor, as increasing inflation can erode the real value of your returns. Being mindful of these risks helps you make more informed investment decisions and diversify your portfolio prudently.

The minimum investment amount varies by bond type. For example, government bonds can sometimes be acquired with a relatively low investment, such as Rs. 1,000.

Interest earned on bonds is taxable as determined by your income tax slab. Some bonds, such as certain sovereign bonds, may offer tax benefits on interest under specific conditions.

Yes, bonds can be sold in the secondary market prior to maturity. The sale price may fluctuate based on market conditions at that time.

AAA-rated bonds are those that carry the highest credit rating, indicating the lowest risk of default and providing greater assurance of payment.

To decide on the right bond, consider your risk tolerance, desired investment duration, and financial goals. Diversification across various types of bonds such as government bonds, corporate bonds, and municipal bonds can help manage risk effectively.

Bonds offer a stable and approachable way to grow wealth in India with predictable returns and balanced risk exposure. By understanding the different types of bonds available, from fixed income securities such as government bonds and corporate bonds to specialized options like municipal bonds, investors can effectively navigate the bond market. Employing strategies like laddering, barbell, or bullet helps align your investments with your future needs responsibly. Moreover, choosing the right digital platform that offers a straightforward and secure process can enhance your overall experience. Ultimately, informed decision-making and careful consideration of associated risks are key to maximizing returns from your bond investments in India.